Why a Company’s Financial Track Record Matters

Investing in stocks is not about chasing tickers — it’s about buying a wonderful business.

A wonderful business usually has three defining traits:

- A sustainable moat that protects its profits

- An excellent financial track record

- Trustworthy management

Among these, an excellent financial track record is a Go/No-Go filter — companies that fail this test should be ignored altogether.

This one step alone can protect you from poor investments and dramatically improve your odds of success.

A company that has delivered consistent performance over 10+ years often also demonstrates the other two traits — a moat and credible leadership — making it worth deeper analysis.

Six Financial Parameters That Define a Great Company

While annual reports can feel overwhelming, you can evaluate a company quickly using six key financial parameters.

When examined together over a 10-year period, they reveal the company’s complete story.

Key Metric | What It Measures | Why It Matters |

Earnings per Share (EPS) | Profits per share | Shows profitability and earnings growth potential |

Net Operating Cash Flow (OCF) | Actual cash generated from operations | Verifies if profits are real, not accounting illusions |

Net Sales | Revenue growth over time | Confirms market demand and pricing power |

Book Value per Share (BVPS) | Value of assets per share | Indicates reinvestment and long-term capital build-up |

Return on Capital Employed (ROCE) | Profit earned on capital invested | Reflects efficiency and quality of management decisions |

Debt-to-Operating Cash Flow | Ability to repay debt from operations | Signals financial resilience and balance-sheet strength |

Let’s explore why each of these parameters matters.

1. Earnings per Share (EPS): The Profit Engine

The first thing any investor should check is whether a company consistently makes profits after tax.

Earnings per Share (EPS) = Profit After Tax ÷ Total Shares Outstanding.

To put it simply:

- If a company earns an EPS of Rs. 7 and trades at Rs. 100, its Earnings Yield is 7%, similar to earning 7% interest on an FD.

- The Price-to-Earnings (P/E) ratio is the inverse of that yield.

Investors pay more than Rs. 100 for such a stock only if they expect future earnings to rise — meaning the business has strong growth prospects.

But remember: reported profits can sometimes mislead.

That’s why the next parameter — Operating Cash Flow — is crucial.

2. Net Operating Cash Flow: The Reality Check

Profits are accounting numbers; cash is real.

A company must be able to convert its reported profits into actual cash inflows.

If a firm consistently reports profits but its Operating Cash Flow (OCF) is weak, it may mean profits are tied up in working capital or receivables — a red flag.

Rule of thumb:

A consistently lower OCF compared to net profit = avoid the company.

3. Net Sales: Growth That Builds Confidence

Profits can’t grow without sales growth.

Examine whether a company’s Net Sales have grown steadily year after year.

Example:

If the paint industry grows at 6% annually and inflation is 4%, a paint manufacturer must grow at least 10% in sales just to maintain its market position and profitability.

Sustained growth in sales and margins signals that the company has pricing power and demand durability — signs of a moat.

4. Book Value per Share (BVPS): Reinvestment for the Future

BVPS shows how much the company is investing back into its own growth.

Strong companies use retained earnings to expand capacity, upgrade technology, or build new products.

If management doesn’t see growth opportunities, they may return profits to shareholders via:

- Dividends, or

- Buybacks (as Infosys and TCS did in 2017)

Both reward shareholders and signal strong capital discipline.

5. Return on Capital Employed (ROCE): Efficiency of Capital

A company is a money-using, money-making machine.

ROCE tells you how efficiently it converts capital (both equity and debt) into profits.

ROCE = EBIT ÷ (Equity + Debt)

A ROCE of 15% means the company earns Rs. 15 for every Rs. 100 of capital employed.

However, ROCE must exceed the Weighted Average Cost of Capital (WACC) — the blended cost of debt and equity.

- If ROCE > WACC → the company creates wealth

- If ROCE < WACC → it destroys wealth

For instance, 15% ROCE is great if WACC is 12%, but poor if WACC is 16%.

6. Debt-to-Operating Cash Flow: Financial Safety First

Debt can accelerate growth — but only if it’s manageable.

This ratio tells you how many years it would take for a company to repay all its debt using operational cash flow.

Rule of thumb: Debt/OCF ≤ 3 is considered healthy.

A higher ratio implies financial strain and increases the risk of default — something that can crash stock prices during downturns.

What Defines an Excellent Financial Track Record?

A company that consistently meets these benchmarks for 10 years or more is likely to be fundamentally strong and well-managed:

Parameter | Benchmark for Excellence |

EPS, Net Sales, BVPS Growth | ≥ 12% CAGR |

ROCE | > 13% every year |

Wealth Creation Index (ROCE – WACC) | Positive |

Debt-to-Operating Cash Flow | ≤ 3 years |

Companies that clear these filters deserve a spot on your Stock Watchlist — they’re potential long-term compounders.

Where to Find These Metrics Easily

You don’t need to sift through 100-page annual reports.

Platforms like MoneyWorks4me simplify financial analysis by presenting all six key parameters in one place, in easy-to-read charts covering the last decade.

That’s how you can separate investment-worthy businesses from the rest — quickly, logically, and confidently.

The Bottom Line

Selecting good stocks starts with identifying companies that have an excellent financial track record.

It’s the first filter that helps you avoid poor businesses and focus on long-term wealth creators.

Great businesses show great numbers — consistently.

Learn to recognize them, and your portfolio will thank you.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

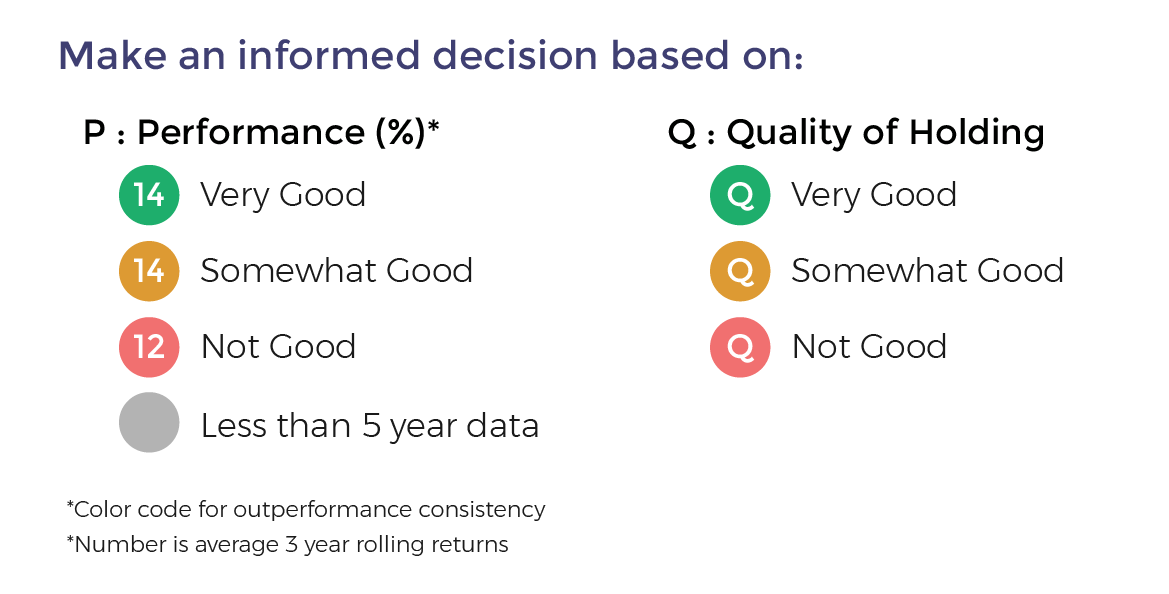

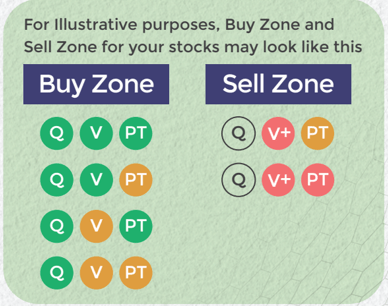

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: